Management of Corporate Actions

Iberclear manages corporate actions carried out regarding securities included in the ARCO system in accordance with the international standards defined by the Corporate Events Joint Working Group (CEJWG) with the purpose of harmonizing all corporate actions related to communication flows, minimum disclosure requirements, key dates and procedures at a European level.

General characteristics

- The issuer entity of the underlying security must inform Iberclear of the single agent bank designated to manage it, which must necessarily be an Iberclear participant, with the exception of General shareholders/bondholders meetings. The exchange of information between Iberclear and the Participants is performed using ISO15022 and ISO20022 standards.

- The issuer and the agent bank must report the corporate action details to Iberclear, which will then check to ensure that the information supplied by both entities is valid and matches. The corporate action announcement will be reported using SWIFT ISO15022 messaging or the BME-PC application.

Types of Corporate Actions

Pursuant to international standards, there are three types of corporate actions:

- Distributions: where the issuer distributes securities or cash to the security holders on a specified date, without any impact on the positions of the securities accounts related to the corporate action.

- Reorganisations: wherever the security associated with the corporate action is replaced with other securities and/or cash.

- Generals: which provide information related to the security code.

This classification applies to both voluntary and mandatory corporate actions.

Mandatory corporate actions

Iberclear manages mandatory corporate actions based on the position held at a given moment by each Participant in a given security code at the close of the record date processes.

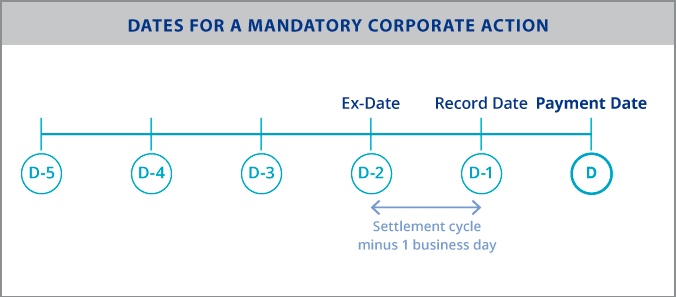

Relevant Dates

- Ex Date: the date from which the security will trade without an entitlement to participate in the corporate action. Ex Date will precede Record Date in a settlement cycle minus one business day.

- Record Date: the date at which the positions will be recorded to calculate the action.

- Last Trading Date: last day of trading for mandatory reorganisations. This must be a at least one settlement cycle prior to Record Date.

- Payment Date: date on which the financial transaction is settled. Payment Date must be after Record Date, preferably the next business day.

According to these dates, positions obtained as the result of a trade made during or after Ex Date are not included, as trades made after that date cannot be included in the corporate action.

Voluntary corporate actions and mandatory with options reorganisations

Iberclear manages voluntary corporate actions and mandatory with options reorganisations when it is optional for holders to participate. Participants will send participation instructions using MT565/ seev.033 messages requesting the secuties quantities for which they want to participate in the elective event.

Relevant dates

- Guaranteed Participation Date: the last trading date of the underlying security with the right attached to participate in the corporate action.

- Buyer Protection Deadline: last date on which the buying counterparty can send a buyer protection instruction to the selling counterparty.

- Market Deadline: the last date on which instructions can be sent to the issuer or its agent bank, based on the options provided by the issuer.

- Payment Date: date on which the corporate action is settled, which must always be after Market Deadline, preferably the next business day.

Market Claims

As a result of a corporate action involving a mandatory cash pay-out or distribution of a number of securities, it may be necessary to generate an adjustment to credit the participant that is actually entitled to this right pursuant to the dates established for this purpose by the issuer. These adjustments will be created in accordance with the market claims standards of the T2S Corporate Action Sub-Group.

Iberclear generates market claims at the end of the record date and, if necessary, during the market claim detection period which covers the 20 business days following the record date.

There are two types of claims:

a) Market Claims, in favour of the buyer: adjustments will be posted for each matched instruction pending settlement with a trade date that is prior to the ex-date.

B) Reverse Claims, in favour of the seller: adjustments will be posted for positions that are not eligible to participate in the corporate action despite being settled on the record date.

Transformations

Whenever the corporate action involves a mandatory or mandatory with options reorganisation such as an exchange, conversion or final redemption of securities, Iberclear will carry out the transformation of matched transactions which are pending settlement at the end of Record Date/Market Deadline. Likewise, at the end of each day for the 20 business days following the record date, Iberclear will transform the trades matched during the transformation detection period in accordance with the default option announced by the agent in the details of the corporate action.

Buyer Protection

This is the process that enables a buyer which did not receive the securities on time, to instruct the seller with the option they would have selected had they received the securities on time.

Once the buyer's instruction is sent to the seller before the buyer protection deadline, if the failed instruction is not settled at the close of that day, both must cancel the instruction pending settlement and issue a new instruction to replace it.

Reversal

If it is necessary to perform a reversal due to an incorrect settlement of a given corporate action, Iberclear will accordingly inform the parties involved and, if necessary, will provide details of the new executed event to correct the cash movements.

Shareholders or Bondholders Meetings

The issuer will notify Iberclear of its forthcoming General Meeting/Assembly as soon as possible and at least three days before Record Date. The notification may be sent via BME-PC.

The issuer must include the information detailed in the Iberclear procedure relating to the notification of shareholders' meetings / bondholders' meetings, including the date and place of the meeting, record date and agenda in both Spanish and English.